Should You Rent Out or Sell Your House?

Figuring out what to do with your house when you’re ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth?

It’s a question many homeowners face, and the answer isn’t always straightforward. Whether you’re curious about the potential income from renting or worried about the responsibilities of being a landlord, there’s a lot to consider.

Let’s walk through some key questions to ask to help you make the best decision for your situation.

Is Your House a Good Fit for Renting?

Even if you’re interested in becoming a landlord, your current house might not be ideal for renting. Maybe you’re moving far away, so keeping up with the ongoing maintenance would be a hassle, the neighborhood isn’t great for rentals, or the house needs significant repairs before you could rent it out.

If any of this sounds like it might apply, selling might be your best option.

Are You Ready for the Realities of Being a Landlord?

Managing a rental property isn’t just about collecting rent checks. It’s a time-consuming and sometimes challenging job.

For example, you may get calls from tenants at all hours of the day with maintenance requests. Or you may find a tenant causes damage you have to repair before the next lease starts. You may even have to deal with people falling behind on payments or breaking their lease early. Investopedia highlights:

“It isn’t difficult to find horror stories of landlords troubled with more headaches than profits. Before deciding to rent, consider talking to other landlords and doing a detailed cost analysis. You might find that selling your home is a better financial decision and less stressful.”

Do You Have a Good Understanding of What It’ll Cost?

If you’re thinking about renting out your home primarily to generate extra income, remember that there are additional costs you’ll want to plan for. As an article from Bankrate explains:

- Mortgage and Property Taxes: You still need to pay these expenses, even if the rent doesn’t cover all of it.

- Insurance: Landlord insurance costs about 25% more than regular home insurance, and it’s necessary to cover damages and injuries.

- Maintenance and Repairs: Plan to spend at least 1% of the home’s value annually, more if the home is older.

- Finding a Tenant: This involves advertising costs and potentially paying for background checks.

- Vacancies: If the property sits empty between tenants, you’ll lose rental income.

- Management and HOA Fees: A property manager can ease the burden, but typically charges about 10% of the rent. HOA fees are an additional cost too, if applicable.

Bottom Line

To sum it all up, selling or renting out your home is a personal decision that depends on your circumstances. Whatever you decide, taking the time to evaluate your options will help you make the best choice for your future.

Make sure to weigh the pros and cons carefully and consult with professionals so you feel supported and informed as you make your decision. That’s what we’re here for.

Are Home Prices Going To Come Down?

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means.

Here’s what Danielle Hale, Chief Economist at Realtor.com, says:

“In stock market terms, a correction is generally referred to as a 10 to 20% drop in prices . . . We don’t have the same established definitions in the housing market.”

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices, which have been increasing rapidly over the last couple years, are normalizing a bit. In other words, they’re now growing at a slower pace. Prices vary a lot by local market, but rest assured, a big drop off isn’t what’s happening at a national level.

The Real Estate Market Is Normalizing

From 2020 to 2022, home prices skyrocketed. That rapid increase was due to high demand, low interest rates, and a shortage of homes for sale. But, that kind of aggressive growth couldn’t continue forever.

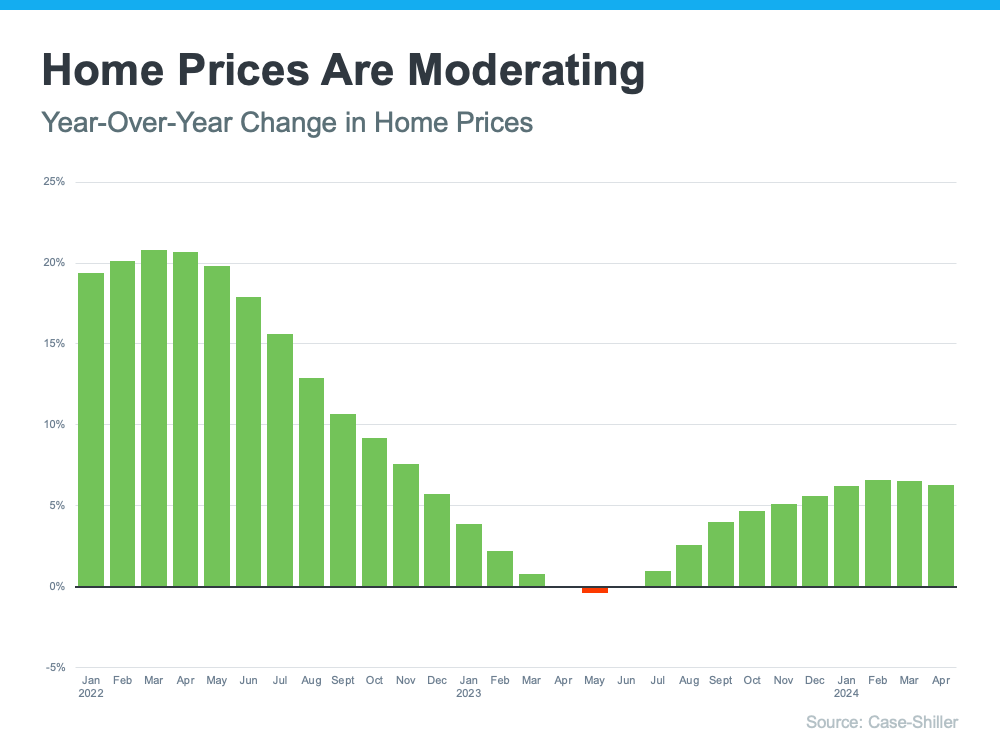

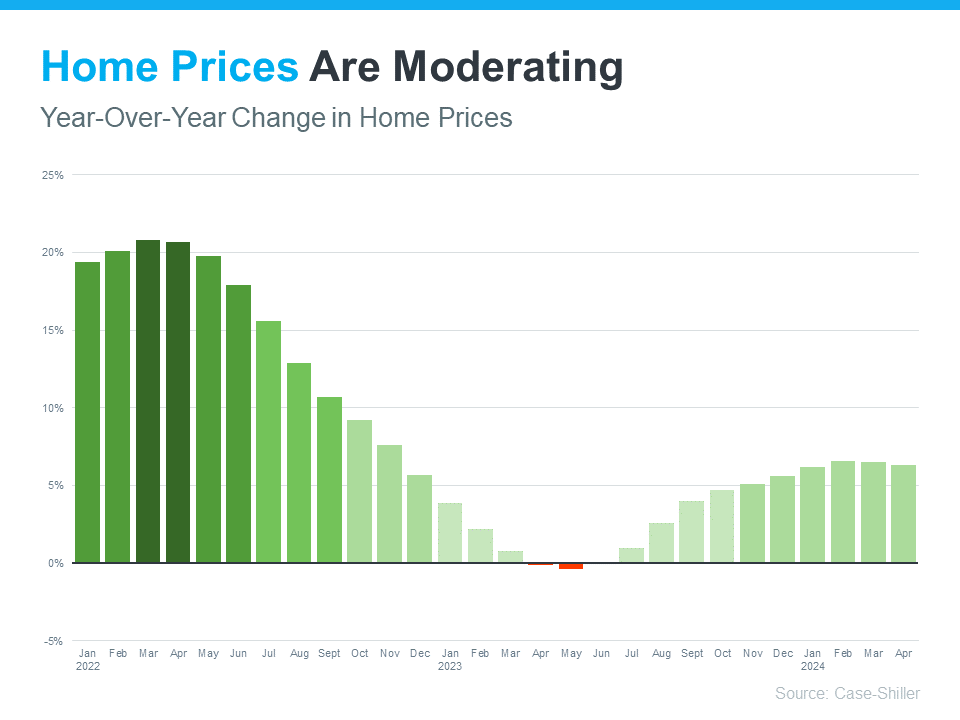

Today, price growth has started to slow down, which is a sign the market is beginning to normalize. The most recent data from Case-Shiller shows that after being basically flat for a couple of months last year, prices are going up at a national level – just not as quickly as before (see graph below):

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

Of course, that’s what’s happening now, but you may be wondering what’s next for prices. Marco Santarelli, the Founder of Norada Real Estate Investments, says:

“Expert forecasts lean towards a moderation in home price growth over the next five years. This translates to a slower and more sustainable pace of appreciation compared to the breakneck speed witnessed in recent years, rather than a freefall in prices.”

It’s all about supply and demand. Increasing inventory plus limited buyer demand, due to relatively high mortgage rates, will continue to ease some of the upward pressure on prices.

What This Means for You

If you’re thinking about buying a home, slowing price growth is welcome news. Skyrocketing home prices during the pandemic left many would-be homebuyers feeling priced-out.

While it’s still a good thing to know the value of the home you buy will likely continue to go up once you own it, slowing price gains are making things feel more manageable. Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help — so the dream of homeownership isn’t boarded up just yet.”

Bottom Line

At the national level, home prices are not going down. And most experts forecast they’ll continue growing moderately moving forward. But prices vary a lot by local market. That’s where a trusted real estate agent comes into play. If you have questions about what’s happening with prices in our area, reach out.

Real Estate Still Holds the Title of Best Long-Term Investment

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting. Here’s some information that could help put your mind at ease by showing that investing in a home is still a powerful decision.

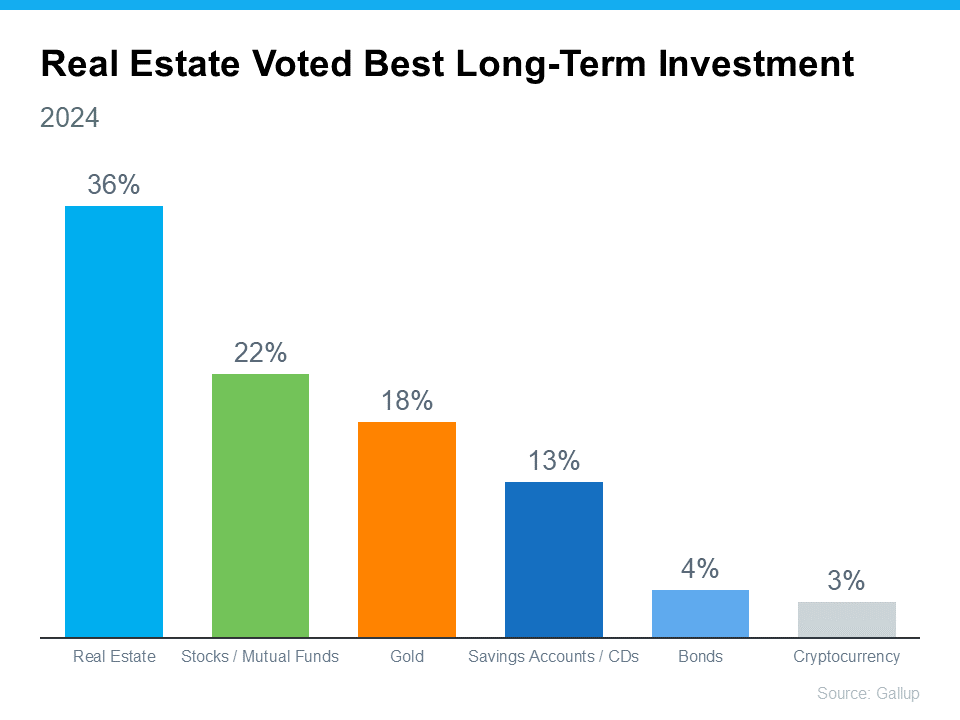

According to the experts at Gallup, real estate has been crowned the top long-term investment for a whopping 12 years in a row. It has consistently beat out other investment types like gold, stocks, and bonds. Just take a look at the graph below – it speaks volumes:

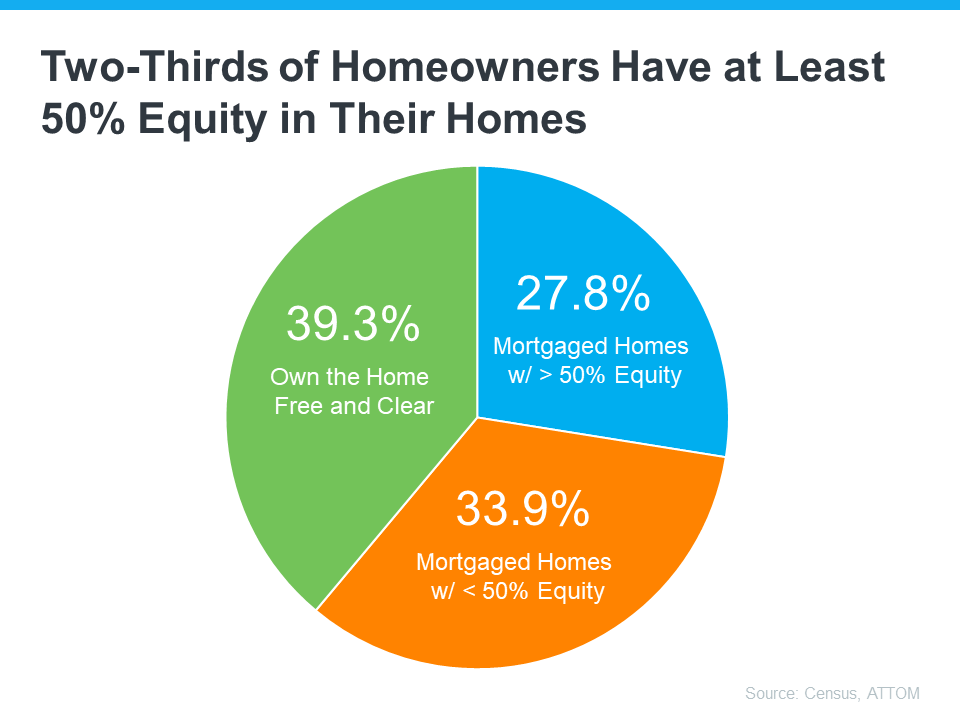

But why does real estate continue to reign supreme as a top-notch long-term investment? It’s because, even today, buying a home can be your golden ticket to building wealth over time.

Unlike other investments that can feel a bit like riding a rollercoaster with all the ups and downs and ongoing risk factors, real estate follows a more predictable and positive pattern.

History shows home values usually rise. And while prices may vary by market, that means as time goes by, your house is likely to appreciate in value. And that helps you grow your net worth in a big way. As an article from Realtor.com explains:

“Homeownership has long been tied to building wealth—and for good reason. Instead of throwing rent money out the window each month, owning a home allows you to build home equity. And over time, equity can turn your mortgage debt into a sizeable asset.”

So, if you’re on the fence about whether to rent or buy, remember that real estate was consistently voted the best long-term investment for a reason. And if you want to get in on that action, it may make sense to go ahead and buy (if you’re ready and able).

Bottom Line

When it comes to building wealth that stands the test of time, real estate is the name of the game. If you’re ready to start on your own journey toward homeownership, let’s connect today.

How Long Will It Take To Sell My House?

You want your house to sell fast. And you may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent.

They have the expertise to tell you how quickly homes are selling in your area and what’s impacting timelines for other sellers. That way you have realistic expectations and can work together to come up with a plan that’s based on today’s market.

Here’s a high-level overview of just one of the factors a great agent will walk you through – the supply of homes for sale and how that impacts your process.

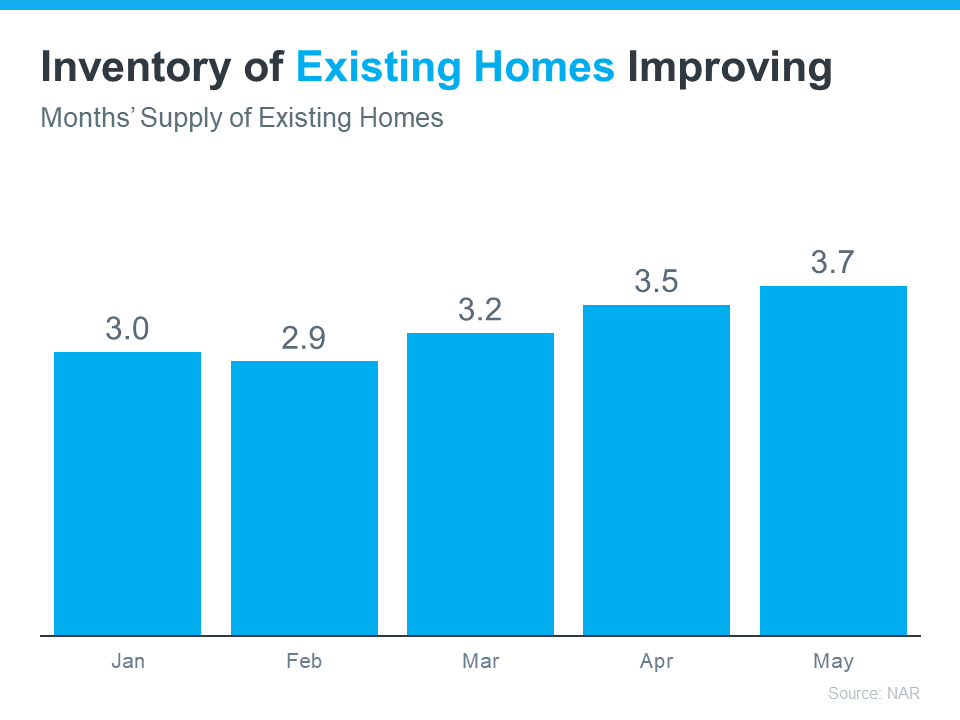

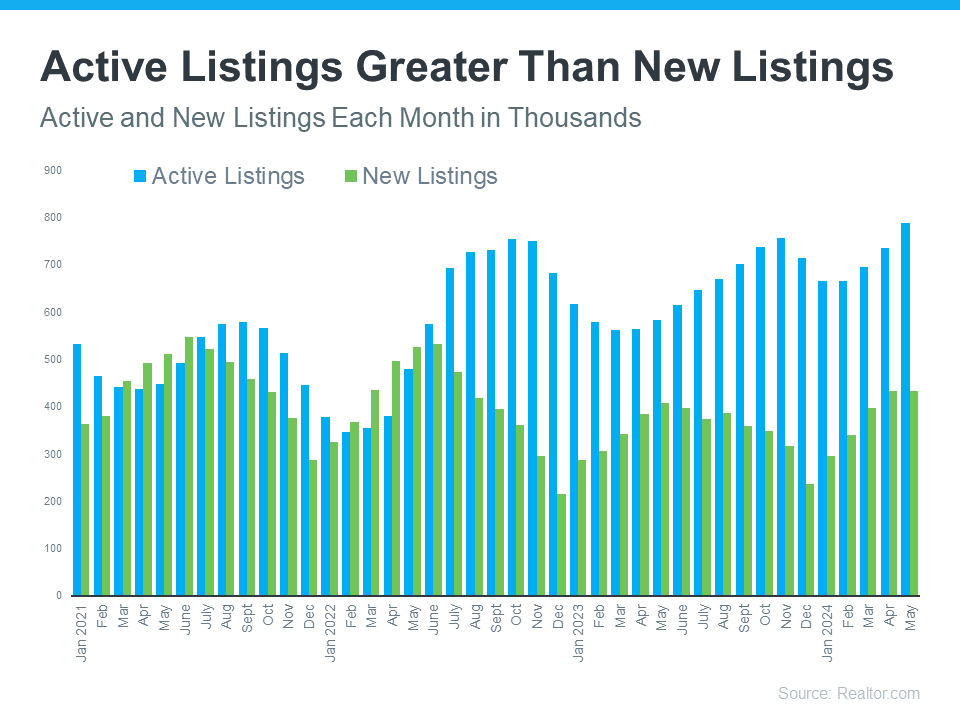

The Growing Supply of Homes for Sale

Over the past few months, the number of homes for sale has increased. This is good news when you move because it means you’ll have more options as you search for your next home. But it also means buyers have more to choose from, so if your house doesn’t stand out – it may take a bit longer to sell.

Available inventory is made up of new listings (homes that were just put up for sale) and active listings (homes that were already on the market but haven’t sold yet). And if you look at data from Realtor.com you can see a good portion of the recent growth is from active listings that are sticking around (see the blue bars in the graph below):

How It’s Impacting Listings Today

Think of the homes on the market like loaves of bread for sale in a bakery. When a fresh batch of bread is put out, everyone wants the newest and hottest one. But if a loaf sits there too long, it starts to get stale, and fewer people want to buy it.

The same goes for homes. New listings are the freshest and most sought-after. But if a home isn’t priced correctly, doesn’t show well, or it doesn’t have an effective sales or marketing strategy behind it, it can sit on the market and become less appealing to buyers over time.

An Agent Will Help Your House Stand Out and Sell Quickly

Timing is important to you. You want to get this done, fast. By leaning on a pro, they’ll make sure your listing is fresh and doesn’t stick around long enough to go stale. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

Your agent will factor the recent inventory growth into their plan and create a customized selling strategy for your house. The supply of homes for sale can vary a lot by area. So they’ll do things like share their valuable insights into what’s happening with supply in your market, help you price your home correctly, and create a marketing plan that gets your home noticed.

Don’t let your listing get stale—reach out to a real estate agent today to make sure your listing is fresh and appeals to buyers from the start. It makes a big difference.

Bottom Line

If you want your house to sell fast, you need to work with a pro. Let’s connect so you’ve got someone who understands the current market trends and how to build a strategy around those factors, so your house is set up to sell quickly.

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

Home Prices Are Expected To Climb Moderately

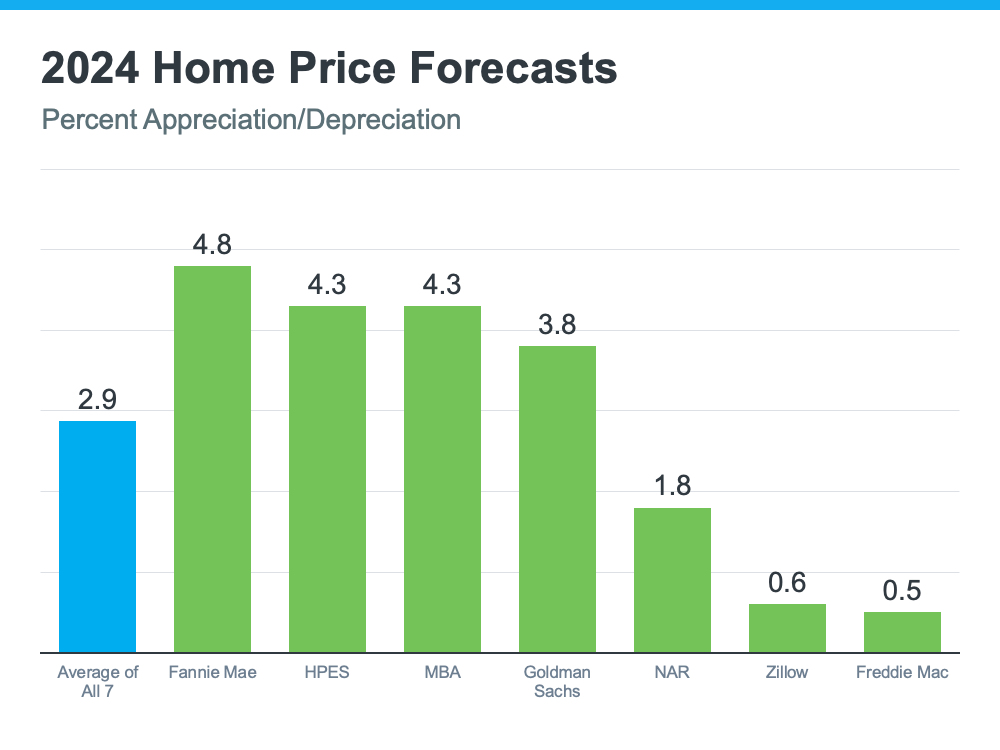

Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry:

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While inventory is up compared to the last couple of years, it’s still low overall. And because there still aren’t enough homes to go around, that’ll keep upward pressure on prices.

If you’re thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. Just remember, prices aren’t expected to drop. They’ll continue climbing, just at a slower pace.

So, getting into the market sooner rather than later could still save you money in the long run. Plus, you can feel confident experts say your home will grow in value after you buy it.

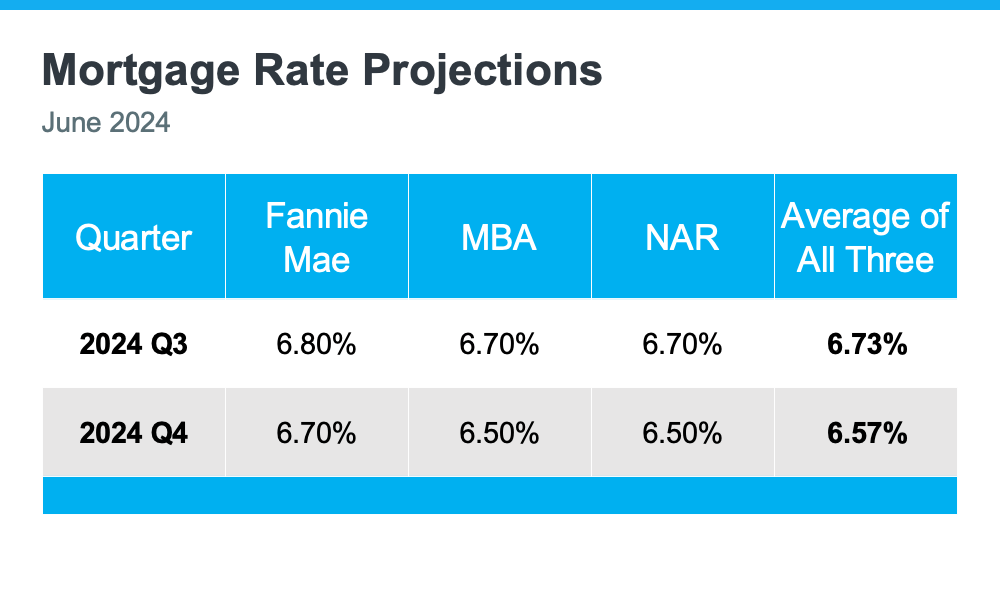

Mortgage Rates Are Forecast To Come Down Slightly

One of the best pieces of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR (see chart below):

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

Home Sales Are Projected To Hold Steady

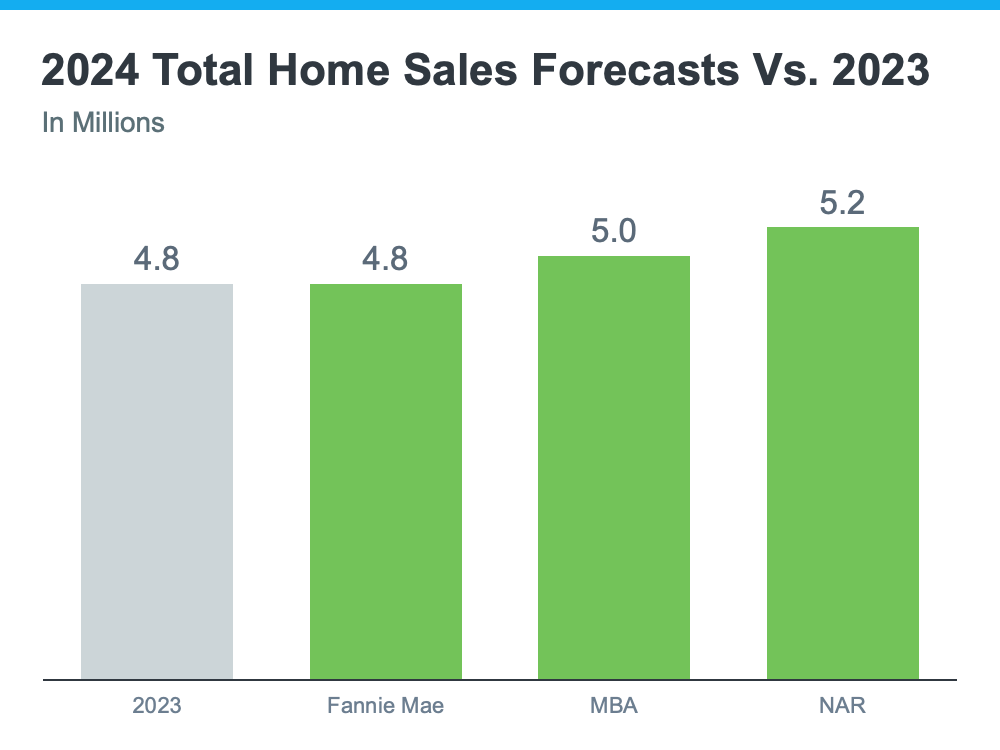

For 2024, the number of home sales will be about the same as last year and may even rise slightly. The graph below compares the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes that sold last year:

The average of the three forecasts is about 5 million sales in 2024 – a small increase from 2023. Lawrence Yun, Chief Economist at NAR, explains why:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates expected to go down, a few more homes are expected to be sold this year compared to last year. This means more people will be able to move. Let’s work together to make sure you’re one of them.

Bottom Line

If you have any questions or need help navigating the market, reach out.

Homebuilders Aren’t Overbuilding, They’re Catching Up

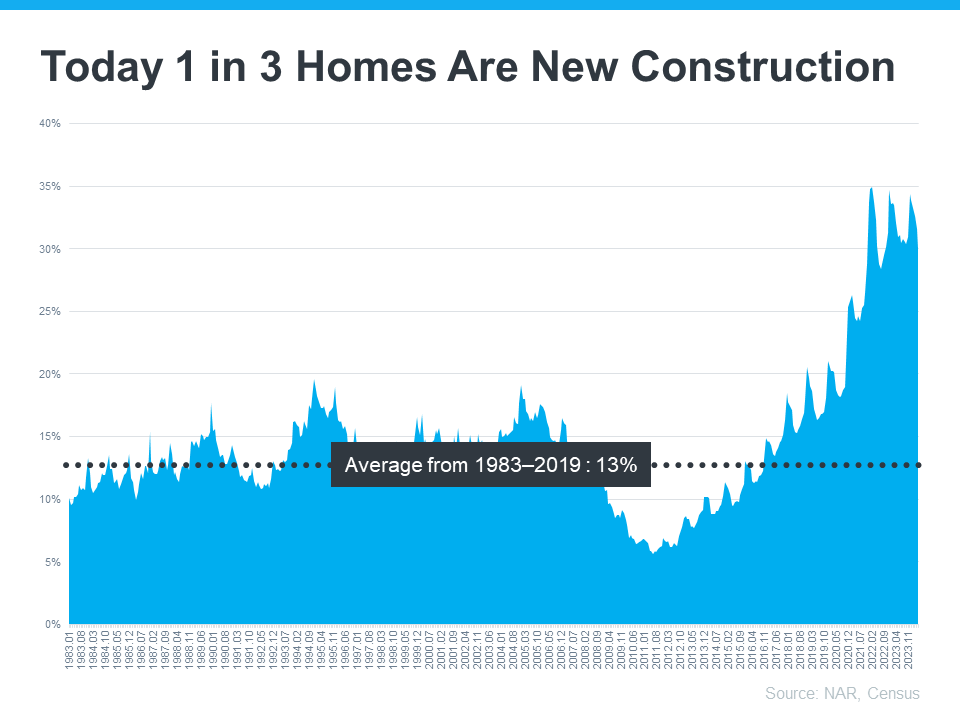

You may have heard that there are more brand-new homes available right now than the norm. Today, about one in three homes on the market are newly built. And if you’re wondering what that means for the housing market and for your own move, here’s what you need to know.

Why This Isn’t Like 2008

People remember what happened to the housing market back in 2008. And one of the factors that contributed to that crash was that there were too many homes for sale. While only part of the oversupply back then came from builders, the lasting impact is that some people still feel uneasy when they hear new home construction has ramped up.

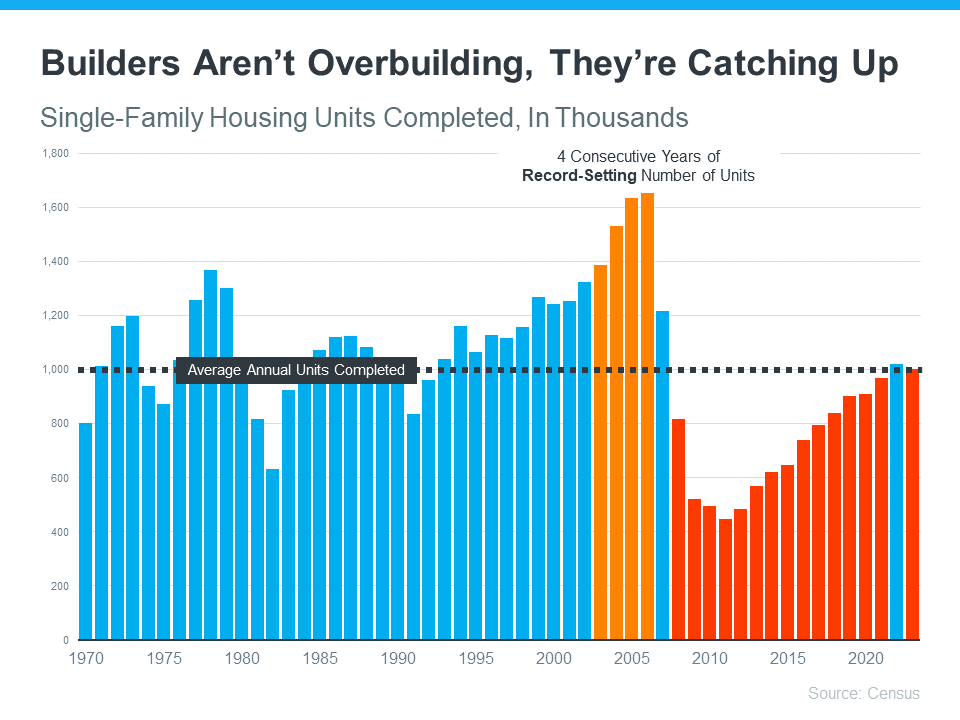

Even though the supply of new homes has grown this year, the data shows there’s no need to worry. Builders aren’t overbuilding, they’re just catching up.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. Following the crash in 2008, there was a long period of underbuilding (shown in red). And it wasn’t until recently that we finally met the long-term average for how many homes are built in a typical year.

This shows, that even with the increase in new builds we’ve seen lately, there won’t suddenly be an oversupply of homes for sale. There’s too much of a gap to make up after over a decade of underbuilding. And if you’re still worried builders are overdoing it, here’s something else that should be reassuring.

New Home Construction May Be at Its Peak for the Year

The latest data from the Census on housing starts (homes where builders just broke ground) and permits (homes where builders can start development soon) shows builders are slowing down their pace right now. Why is that?

They’re responding to still high mortgage rates and how those are impacting buyer demand. Basically, they’re pulling back appropriately in response to what’s happening in the market. As an article from HousingWire explains:

“Even with a massive housing shortage across the nation, homebuilders are completing their pipelines and not seeking as many permits to construct new single-family houses.”

Builders remember what happened when they overbuilt in the crash, and they’re looking to avoid a repeat of that. So, they’re being mindful and pulling back a bit.

You May Have More Options Now Versus Later

If you’re considering a newly built home, here’s how this impacts you. With builders seeking fewer permits and not breaking ground on as many new homes, we may be at the peak of new home construction for the year. This doesn’t mean new home construction is screeching to a stop – just that the pace is slowing down now, and that’ll impact what comes to market later this year. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Given the recent declines in housing starts, home completions will steadily show declines in about six months.”

So, if you’re ready and able to buy now, you may find you’ll have more newly built options to choose from now versus later on. This may be enough reason to kick off your search.

Just be sure to work with a local real estate agent you know and trust throughout the process. An agent will have valuable insight into builder reputations and other key factors specific to your market. And if there isn’t much new construction near you, they’ll be able to point you toward a nearby area where there is.

Bottom Line

While it’s true new home construction is a bigger segment of the market than the norm, that’s not a bad thing. Builders aren’t overbuilding, and they’re responding to market signals to avoid repeating the mistakes that were made in 2008.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link