What’s Motivating Your Move?

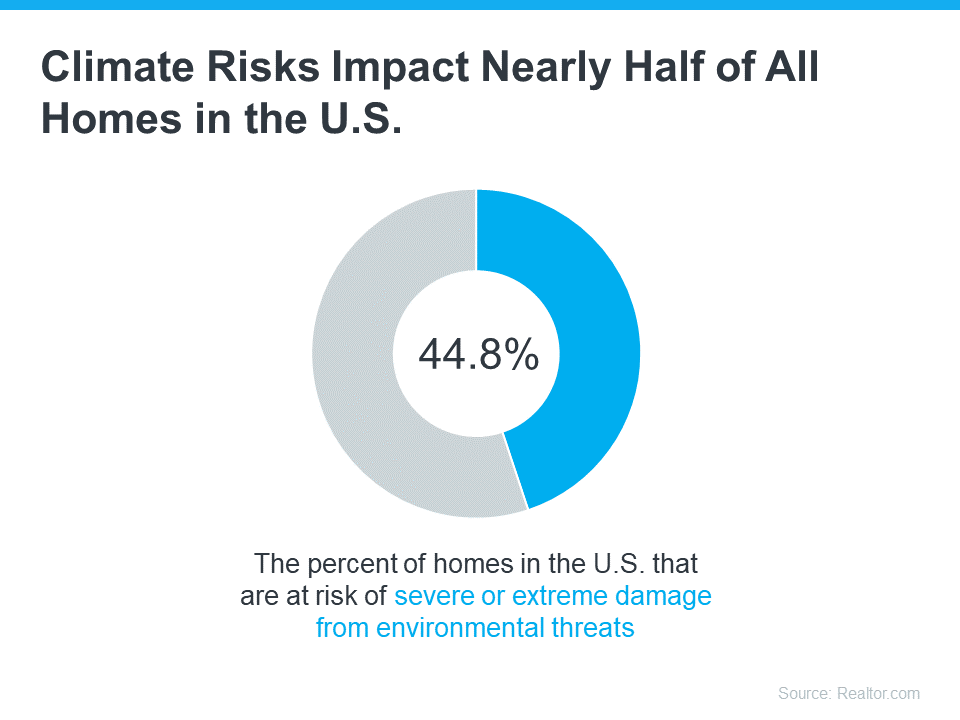

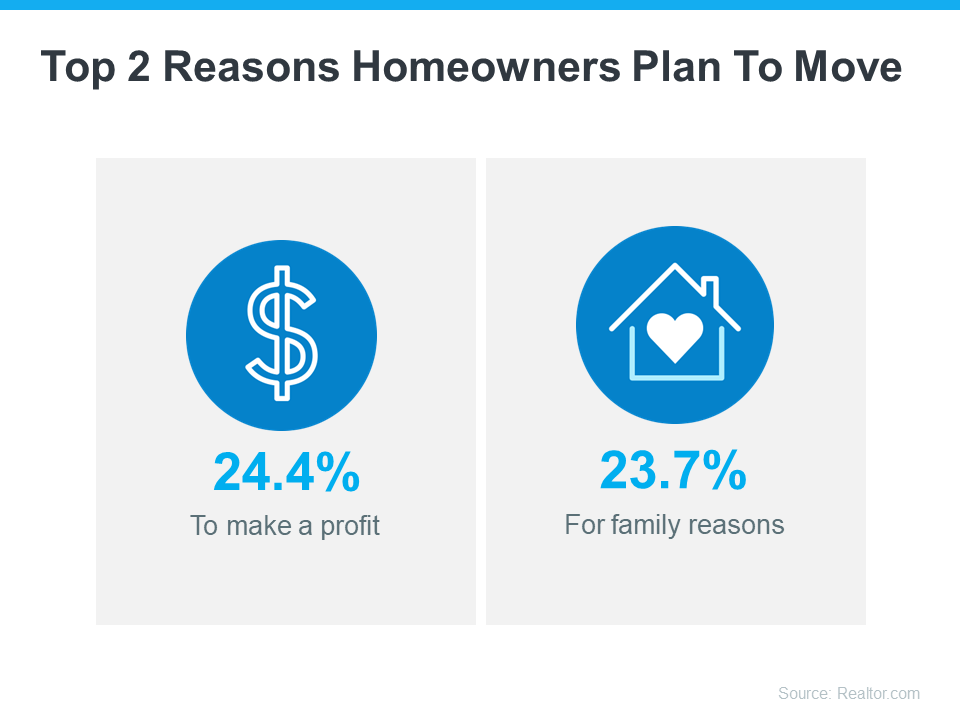

Thinking about selling your house? As you make your decision, consider what’s pushing you to think about moving. A recent survey from Realtor.com looked into why people want to sell their homes this year. Here are the top two reasons (see graphic below):

Let’s take a closer look and see if they’re motivating you to make a change too.

1. To Make a Profit

If you’re thinking about selling your house, you probably have a lot of questions on your mind. Well, here’s some good news – the latest data shows most sellers get a great return on their investment when they sell. ATTOM, a property data provider, explains:

“. . . home sellers made a $121,000 profit on the typical sale in 2023, generating a 56.5 percent return on investment.”

That’s significant. And here’s one contributing factor. During the pandemic, home prices skyrocketed. There was way more buyer demand than homes available for sale and that combination pushed prices up.

Now, home prices are still rising, just not as fast. That ongoing appreciation is good news for your bottom line. Any profit you make can help offset some of today’s affordability challenges when you buy your next home.

If you want to know how much your house is worth now and what’s going on with prices in your area, talk to a local real estate agent.

2. For Family Reasons

Maybe you want to be near relatives to help take care of older family members or to have more support nearby. Or maybe you’re just eager to spend time together on special occasions like birthdays and holidays.

Selling a house and moving closer to the people who matter the most to you helps keep you connected. If the distance is making you miss out on some big milestones in their lives, it might be time to talk to a local real estate agent to find a place close by. The National Association of Realtors (NAR) says:

“A great real estate agent will guide you through the home search with an unbiased eye, helping you meet your buying objectives while staying within your budget.”

Bottom Line

If you’re thinking about selling your house, there’s probably a good reason for it. Let’s talk so you have help making the right move to reach your goals this year.

Now’s a Great Time To Sell Your House

Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move.

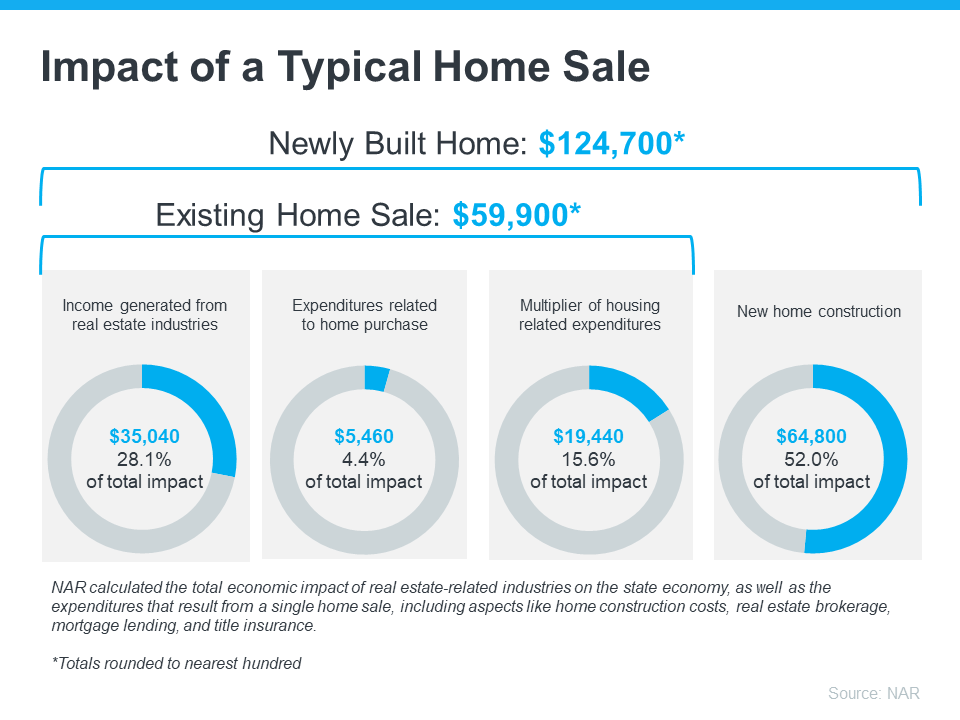

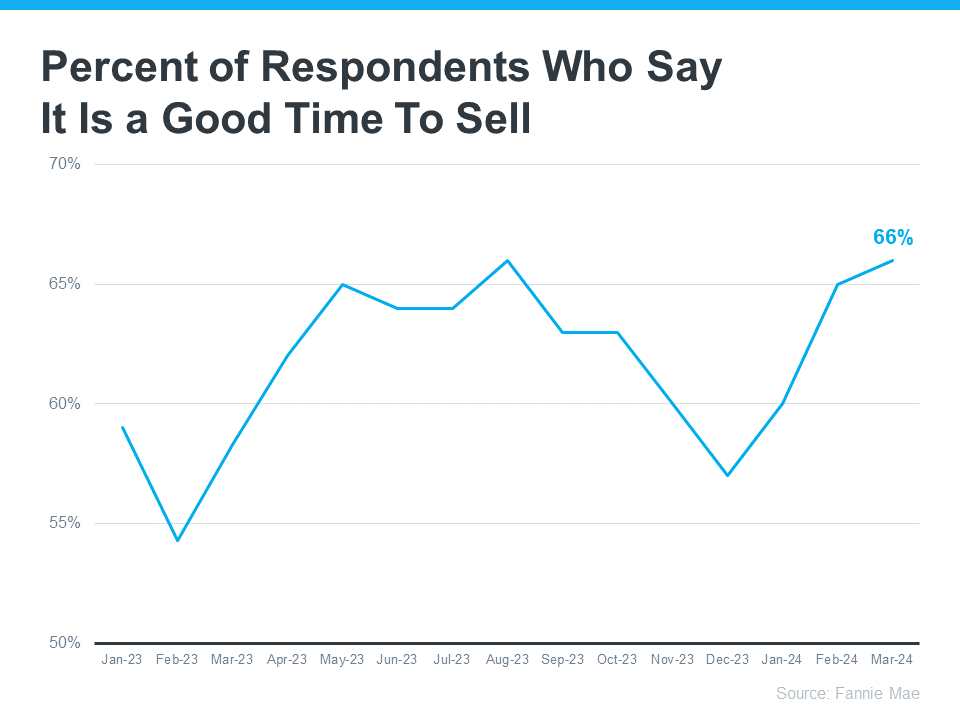

Here’s something else to consider. According to the latest Home Purchase Sentiment Index (HPSI) from Fannie Mae, the percent of respondents who say it’s a good time to sell is on the rise (see graph below):

Why Are Sellers Feeling so Optimistic?

One reason why is because right now is traditionally the best time of year to sell a house. A recent article from Bankrate says:

“Late spring and early summer are generally considered the best times to sell a house. . . . While today’s rates are relatively high, low inventory is still keeping sellers in the driver’s seat in most markets.”

These are the seasons when most people move. That means buyer demand grows. And because there still aren’t enough homes for sale to meet that demand, sellers see some serious perks. According to Rocket Mortgage:

“Homes that are listed at the end of spring and the beginning of summer typically sell faster at a higher sales price.”

What Does This Mean for You?

More sellers are coming to realize conditions are ripe for a move. And that’s one reason why we’re seeing more homeowners put their homes up for sale. If you think you might want to get in on the action, it’s a good idea to start preparing.

A local real estate agent can help you get your house ready by offering advice on how best to fix it up and make it appealing to buyers in your area.

They also know if you list during the peak buying seasons of spring and early summer, you might sell quickly and for a higher price.

Bottom Line

If you list during the spring and early summer, you might sell your house quickly and for a higher price. When you’re ready to make the most of today’s seller’s market, let’s get in touch.

Is It Getting More Affordable To Buy a Home?

Over the past year or so, a lot of people have been talking about how tough it is to buy a home. And while there’s no arguing affordability is still tight, there are signs it’s starting to get a bit better and may improve even more throughout the year. Elijah de la Campa, Senior Economist at Redfin, says:

“We’re slowly climbing our way out of an affordability hole, but we have a long way to go. Rates have come down from their peak and are expected to fall again by the end of the year, which should make homebuying a little more affordable and incentivize buyers to come off the sidelines.”

Here’s a look at the latest data for the three biggest factors that affect home affordability: mortgage rates, home prices, and wages.

1. Mortgage Rates

Mortgage rates have been volatile this year – bouncing around in the upper 6% to low 7% range. That’s still quite a bit higher than where they were a couple of years ago. But there is a sliver of good news.

Despite the recent volatility, rates are still lower than they were last fall when they reached nearly 8%. On top of that, most experts still think they’ll come down some over the course of the year. A recent article from Bright MLS explains:

“Expect rates to come down in the second half of 2024 but remain above 6% this year. Even a modest drop in rates will bring both more buyers and more sellers into the market.”

Any drop in rates can make a difference for you. When rates go down, you can afford the home you really want more easily because your monthly payment would be lower.

2. Home Prices

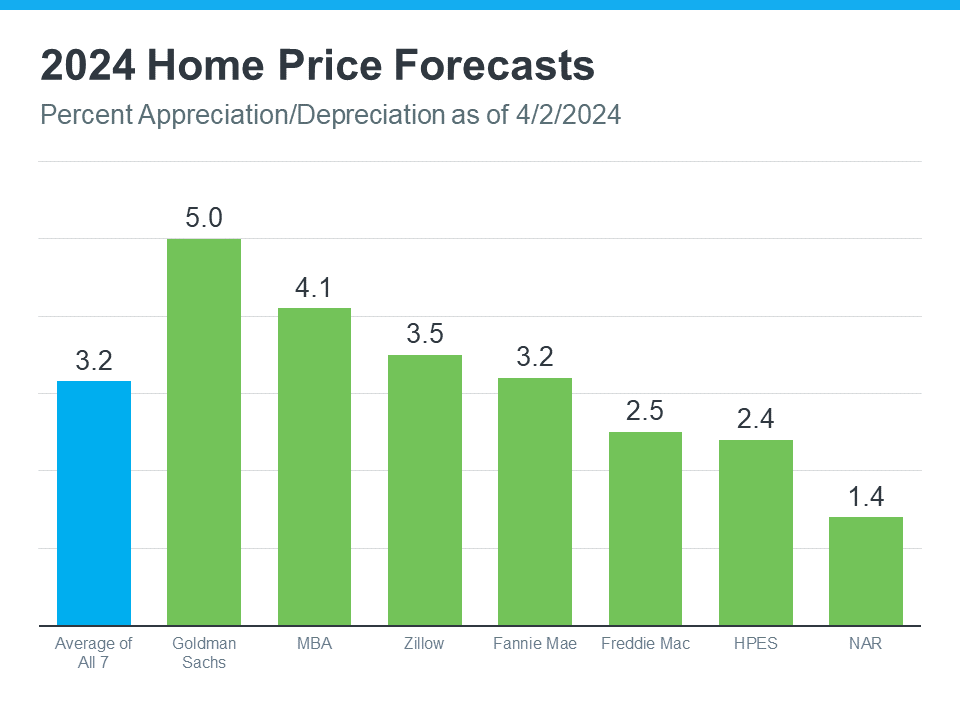

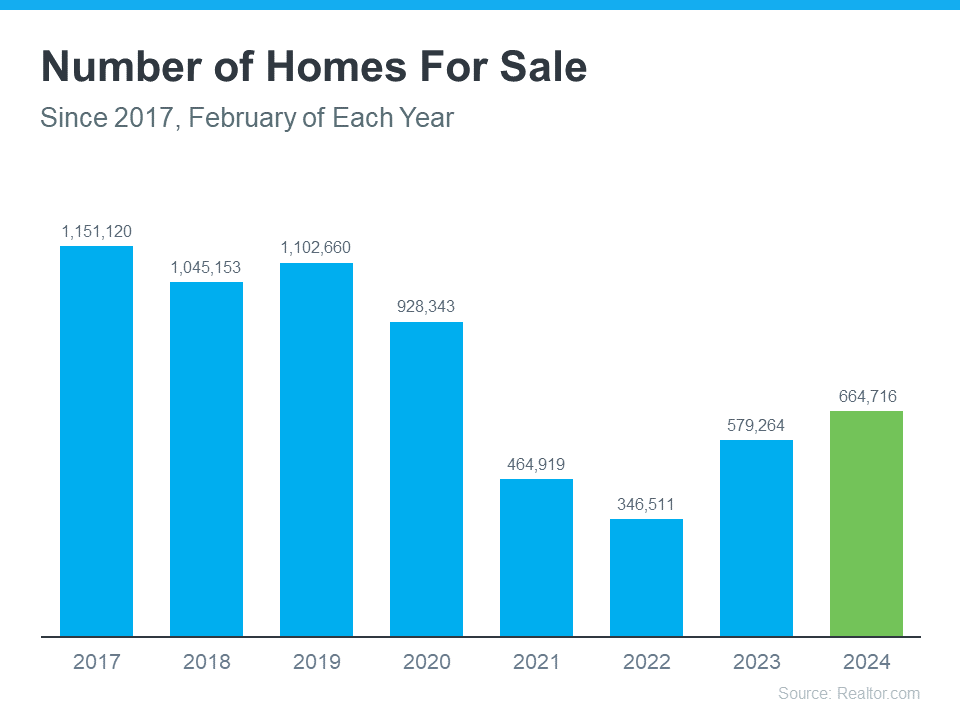

The second big factor to think about is home prices. Most experts project they’ll keep going up this year, but at a more normal pace. That’s because there are more homes on the market this year, but still not enough for everyone who wants to buy one. The graph below shows the latest 2024 home price forecasts from seven different organizations:

These forecasts are actually good news for you because it means the prices aren’t likely to shoot up sky high like they did during the pandemic. That doesn’t mean they’re going to fall – they’ll just rise at a slower pace.

3. Wages

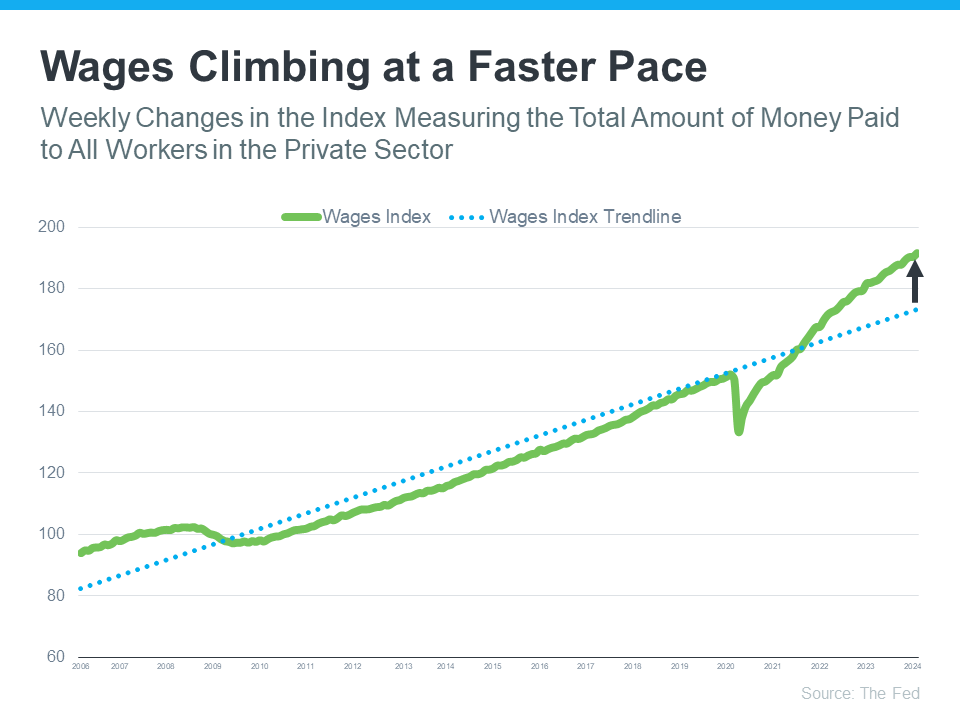

One factor helping affordability right now is the fact that wages are rising. The graph below uses data from the Federal Reserve to show how wages have been growing over time:

Check out the blue dotted line. That shows how wages typically rise. If you look at the right side of the graph, you’ll see wages are climbing even faster than normal right now.

Here’s how this helps you. If your income has increased, it’s easier to afford a home because you don’t have to spend as big of a percentage of your paycheck on your monthly mortgage payment.

Bottom Line

If you stack these factors up, you’ll see mortgage rates are still projected to come down a bit later this year, home prices are going up at a more moderate pace, and wages are growing quicker than normal. Those trends are a good sign for your ability to afford a home.

Ways To Use Your Tax Refund If You Want To Buy a Home

Have you been saving up to buy a home this year? If so, you know there are a number of expenses involved – from your down payment to closing costs. But did you also know your tax refund can help you pay for some of these expenses? As Credit Karma explains:

“If one of your goals is to stop renting and buy a home, you’ll need to save up for closing costs and a down payment on the mortgage. A tax refund can give you a start on the road to homeownership. If you’ve already started to save, your tax refund could move you down the road faster.”

While how much money you may get in a tax refund is going to vary, it can be encouraging to have a general idea of what’s possible. Here’s what CNET has to say about the average increase people are seeing this year:

“The average refund size is up by 6.1%, from $2,903 for 2023’s tax season through March 24, to $3,081 for this season through March 22.”

Sounds great, right? Remember, your number is going to be different. But if you do get a refund, here are a few examples of how you can use it when buying a home. According to Freddie Mac:

- Saving for a down payment – One of the biggest barriers to homeownership is setting aside enough money for a down payment. You could reach your savings goal even faster by using your tax refund to help.

- Paying for closing costs – Closing costs cover some of the payments you’ll make at closing. They’re generally between 2% and 5% of the total purchase price of the home. You could direct your tax refund toward these closing costs.

- Lowering your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If affordability is tight for you at today’s rates and home prices, this option may be worth exploring. If you qualify for this option, you could pay upfront to have a lower rate on your mortgage.

The best way to get ready to buy a home is to work with a team of trusted real estate professionals who understand the process and what you’ll need to do to be ready to buy.

Bottom Line

Your tax refund can help you reach your savings goal for buying a home. Let’s talk about what you’re looking for, because your home may be more within reach than you think.

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans. Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you could still qualify for a home loan even with that debt? Here’s a look at the latest information so you have the answers you need.

A Bankrate article explains:

“Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.”

This includes one of the biggest financial decisions you’ll ever make, buying a home. But you should know, even with student loans, waiting to buy a home may not be necessary. While everyone’s situation is unique, your goal may be more within your reach than you realize. Here’s why.

Can You Qualify for a Home Loan if You Have Student Loans?

According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000.

That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says:

“. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .”

The key takeaway is, for many people, homeownership is achievable even with student loans.

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals. A trusted lender can walk you through your options based on your situation, and share what’s worked for other buyers.

Bottom Line

Lots of other people with student loan debt are able to buy their own homes. Talk to a lender to go over your options and see how close you are to reaching your goal.

The Best Week To List Your House Is Almost Here

Are you thinking about making a move? If so, now may be the perfect time to start the process. That’s because experts say the best week to list your house is just around the corner.

A recent Realtor.com study looked at housing market trends over the past several years (with the exception of 2020, since it was an unusual year), and found the best week to put your house on the market this year is April 14-20:

“Every year, one week stands out from the rest as that perfect stretch of time when it’s great to be a home seller. This year, the week of April 14–20 is the best time to sell—that is, if sellers want to see lots of interest in their homes, sell quickly, and pocket some extra cash, according to Realtor.com® data.”

Here’s why this matters for you. While the spring market is a great time to sell no matter the week, this may be the peak sweet spot. And if you’ve been putting your plans on the back burner and waiting for the right time to act, this could be the nudge you need to make your move happen. As Hannah Jones, Senior Economic Research Analyst at Realtor.com explains:

“The third week of April brings the best combination of housing market factors for sellers. The best week offers higher buyer demand, lower competition [from other sellers], and fewer price reductions than the typical week of the year.”

But, if you want to get in on the action, you’ll need to move quickly and lean on the pros. Your local real estate agent is the perfect go-to when it comes to figuring out a plan to prep your house and get it on the market.

They’ll be able to offer advice to balance your target listing date with what you need to do from a repair and renovation standpoint. And they can walk you through exactly how to prioritize your list so you know what to tackle first.

For example, if your house is already in good shape, you’ll be able to really focus in on the smaller things that are easy to do and make a big impact. As an article from Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are some specific examples from that article:

Just remember, even if you’re not ready to list within the next couple of weeks, that’s okay. The window of opportunity doesn’t close when this week ends. Spring is the peak homebuying season and it’s still a seller’s market, so you’ll be in the driver’s seat all season long.

Bottom Line

Ready to get the ball rolling? Let’s connect and schedule a time to go over your next steps.

Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home? If so, you’re probably wondering: should I buy now or wait? Nobody can make that decision for you, but here’s some information that can help you decide.

What’s Next for Home Prices?

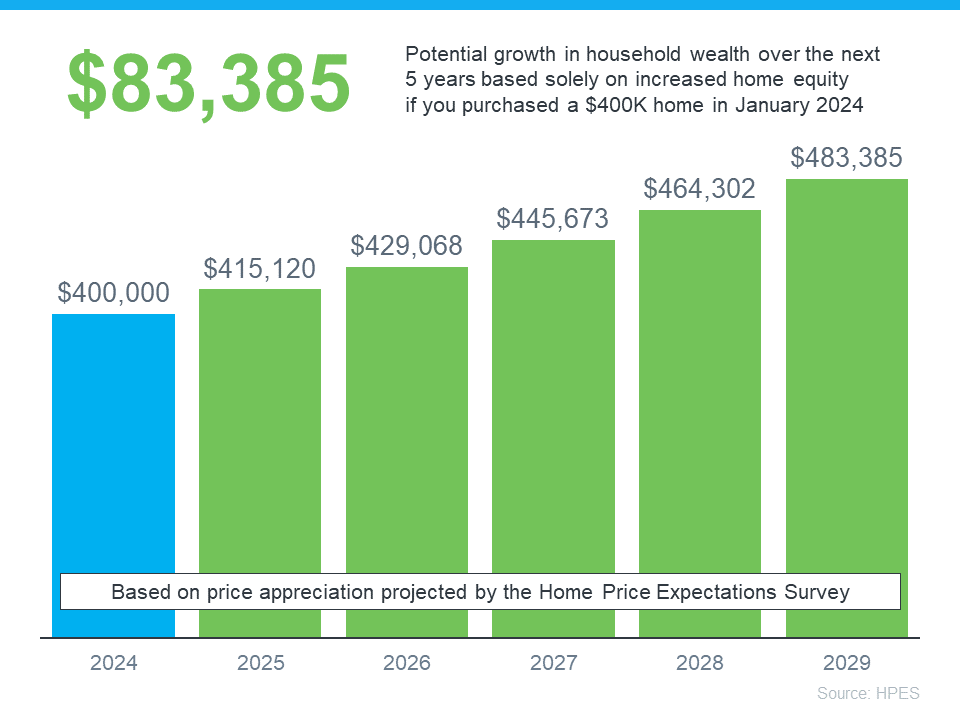

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

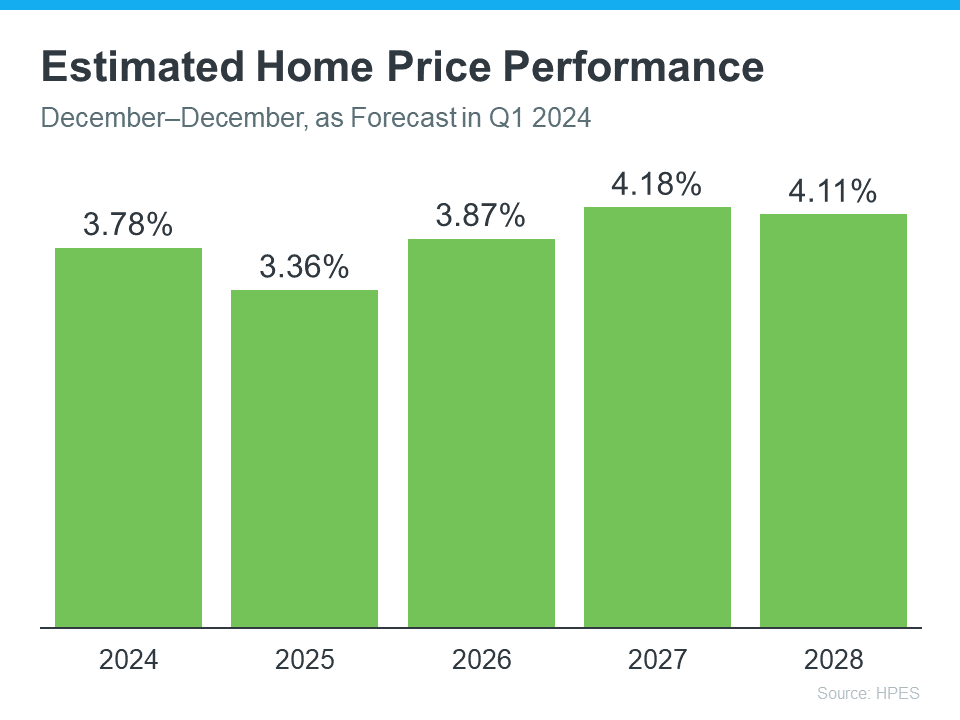

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home’s value goes up by 3.78% this year, it’s set to grow another 3.36% next year. And another 3.87% the year after that.

What Does This Mean for You?

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link