The Truth About Down Payments

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

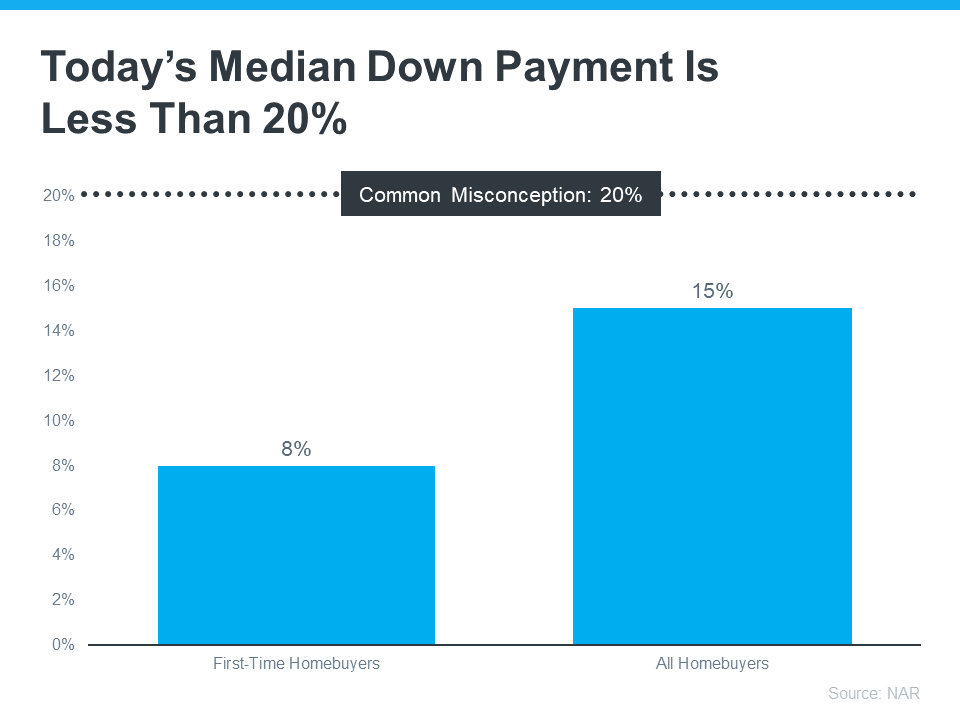

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don't always need a 20% down payment to buy a home. If you're looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

More from the front porch...

4 Tips To Make Your Strongest Offer on a Home

Are you thinking about buying a home soon? If so, you should know today’s market is competitive in many areas because the number of homes for sale is still low – and that’s leading to multiple-offer scenarios. And moving into the peak home buying season this spring, this is only expected to ramp up more. Remember these […]

Read More747 Windham Way

SOLD → 747 Windham Way, Chico $585,000 MLS ID: 223100750 Bedrooms: 4 Bathrooms: 2.5 Square Feet: 2,523 Year Built: 2012 Lot Size: 11,326 sq. ft. Subdivision: Creekside Landing Size: Two Story Parking: Garage (2 Car) HOA: No 🗓️ Schedule Showing 📧 Contact Bebe 📞 707.803.0598 Bed & […]

Read MoreFinding Your Perfect Home in a Fixer Upper

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market […]

Read More4401 Avondale Cir

SOLD → 4401 Avondale Cir. Fairfield $1,400,000 MLS ID: 324004514 Bedrooms: 4 Bathrooms: 3 Square Feet: 3,477 Year Built: 2012 Lot Size: 26,589 sq. ft. Subdivision: Paradise Valley Size: Multi Story Parking: 3 Car Garage HOA: Yes $49/Month 🗓️ Schedule Showing 📧 Contact Us 📞 […]

Read MoreWhat To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An […]

Read MoreThe Truth About Down Payments

The Truth About Down Payments If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case. Unless specified by […]

Read MoreWays Your Home Equity Can Help You Reach Your Goals

If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this: “. . . your home’s equity is the difference between how much your home is worth and how much you […]

Read MoreDown Payment Assistance Programs Can Help Pave the Way to Homeownership

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think: Data from NAR shows the […]

Read MoreWhen You Sell Your House, Where Do You Plan To Go?

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able […]

Read MoreThinking About Using Your 401(k) To Buy a Home?

📈 Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

Read More