The Truth About Down Payments

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

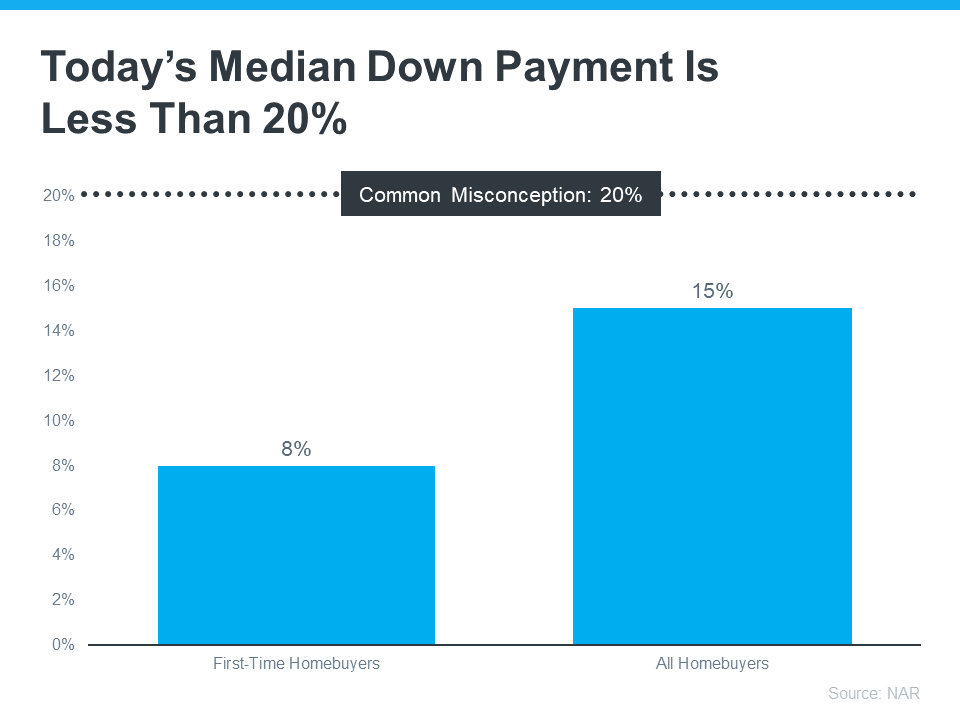

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don't always need a 20% down payment to buy a home. If you're looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

More from the front porch...

Should You Rent Out or Sell Your House?

Figuring out what to do with your house when you’re ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth? It’s a question many homeowners face, and the answer isn’t always straightforward. Whether you’re curious about the […]

Read MoreAre Home Prices Going To Come Down?

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means. Here’s what Danielle Hale, Chief Economist at Realtor.com, says: “In stock […]

Read MoreReal Estate Still Holds the Title of Best Long-Term Investment

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting. Here’s some information that could help put your mind at ease by showing that investing in a home is still a powerful decision. According to the experts […]

Read MoreHow Long Will It Take To Sell My House?

You want your house to sell fast. And you may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent. They have the expertise to tell you how quickly homes are selling in your area and what’s impacting timelines for other sellers. That way you have realistic […]

Read MoreHousing Market Forecast: What’s Ahead for the 2nd Half of 2024

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry: […]

Read MoreHomebuilders Aren’t Overbuilding, They’re Catching Up

You may have heard that there are more brand-new homes available right now than the norm. Today, about one in three homes on the market are newly built. And if you’re wondering what that means for the housing market and for your own move, here’s what you need to know. Why This Isn’t Like 2008 People remember what happened to […]

Read More