4 Tips To Make Your Strongest Offer on a Home

Are you thinking about buying a home soon? If so, you should know today’s market is competitive in many areas because the number of homes for sale is still low – and that’s leading to multiple-offer scenarios. And moving into the peak home buying season this spring, this is only expected to ramp up more.

Remember these four tips to make your best offer.

1. Partner with a Real Estate Agent

Rely on a real estate agent who can support your goals. As PODS notes:

“Making an offer on a home without an agent is certainly possible, but having a pro by your side gives you a massive advantage in figuring out what to offer on a house.”

Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for. That advice can be game changing when you’re deciding what offer to bring to the table.

2. Understand Your Budget

Knowing your numbers is even more important right now. The best way to understand your budget is to work with a lender so you can get pre-approved for a home loan. Doing so helps you be more financially confident and shows sellers you’re serious. That gives you a competitive edge. As Investopedia says:

“. . . sellers have an advantage because of intense buyer demand and a limited number of homes for sale; they may be less likely to consider offers without pre-approval letters.”

3. Make a Strong, but Fair Offer

It’s only natural to want the best deal you can get on a home, especially when affordability is tight. However, submitting an offer that’s too low does have some risks. You don’t want to make an offer that’ll be tossed out as soon as it’s received just to see if it sticks. As Realtor.com explains:

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

The expertise your agent brings to this part of the process will help you stay competitive and find a price that’s fair to you and the seller.

4. Trust Your Agent During Negotiations

After you submit your offer, the seller may decide to counter it. When negotiating, it’s smart to understand what matters to the seller. Once you do, being as flexible as you can on things like moving dates or the condition of the house can make your offer more attractive.

Your real estate agent is your partner in navigating these details. Trust them to lead you through negotiations and help you figure out the best plan. As an article from the National Association of Realtors (NAR) explains:

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

Bottom Line

In today’s competitive market, let’s work together to find you a home you love and craft a strong offer that stands out.

747 Windham Way

SOLD

→ 747 Windham Way, Chico

$585,000

| MLS ID: 223100750

Bedrooms: 4 Bathrooms: 2.5 Square Feet: 2,523 Year Built: 2012 |

Lot Size: 11,326 sq. ft.

Subdivision: Creekside Landing Size: Two Story Parking: Garage (2 Car) HOA: No |

- Breakfast Bar

- Laundry Room Upstairs

- Huge Lot 11,326 sq. ft.

- Covered Back Patio

- RV Parking

- Planter Beds

- Firepit

- 2 Car Garage

With Navigate Real Estate, the process of selling homes and land transcends the conventional approach; it's an artful orchestration of strategy, storytelling, and cutting-edge marketing techniques. Each property is meticulously assessed, and a tailored plan is strategized to ensure maximum exposure and appeal. This approach begins with understanding the unique features and selling points of the home, allowing us to craft a compelling narrative that resonates with potential buyers.

411 Jacquelyn Lane stands as a prime example. Sold by Bebe Sorenson, this meticulously marketed property exemplifies Navigate's dedication to delivering results that exceed expectations.

HOW WE DO IT

- Starts With A Consultation

- 4kHD Video Walkthrough

- Schedule Broker Open

- Create Property Website

- Install For Sale Sign

- Send Through Navigate Network

- Strategically Stage Home

- Drone Airel Photo/Video

- Schedule Open House

- Mass Email Campaign

- Invite Neighbors

- Share Through Social Networks

- Professional Photography

- Professional Written Description

- Create Floor Plans

- Create Brochures

- Advertise your Home

- Folow Up On All Leads

Every Home Has A Story. ..

With our navi in-house marketing agency, we believe each property is different and requires a unique approach to marketing. We will work together and agree upon the best strategy for positioning your home for sale. We approach each real estate transaction differently - working diligently to ensure that each property has its own unique personality and purpose. Our team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

navi

When Bebe Sorenson started her real estate career in 2005 she knew she would enjoy helping others achieve their real estate goals. As time went on she realized that buying or selling real estate is one of the most significant decisions a person will make in a lifetime. Since then it's been her mission to create a smooth efficient experience expertly handled from start to finish.

Bebe prides herself on being attentive to her clients' needs so she can help them make the best choices for their families.

As a forty-five+year resident of Solano County, she has a native's understanding of the area and understands that selling a home is more than putting a sign in the yard. That's why buyers sellers and investors depend on her to guide them and say she is knowledgeable present available and always dedicated to serving their needs.

When not helping her clients Bebe enjoys spending time with her family. She's been happily married for thirty-five+ years and has four children and 9 grandchildren she adores.

+1 707-803-0598 | BebeSorenson@Gmail.com | DRE Lic# 01723224

WHO YOU WORK WITH MATTERS

OUR

PHILOSOPHY

Better companies make better communities.

We believe our business has a responsibility to serve, connect, grow and protect the communities we operate in.

OUR VALUES

Independence is worth preserving.

Our independence matters more than our size. It allows us to prioritize our community involvement and better serve our agents and clients.

Social impact at the center.

Everything we do has a cause and effect. We maintain a responsibility to contribute to every community in which we operate.

Communities over shareholders.

If our business has to grow at the expense of the communities around us, it isn't worth it. It is important to us to continually invest in building community.

Growth for the sake of bigger impact.

We grow our business to become a stronger, independent network of individuals who benefit as a result of more resources.

Every Home Has A Story...

Every Home Has A Story...

Raving Fans...

"Could not have done this process.without Ms Bebe Sorensen at our side. She walked My Wife and I slowly and patiently through the whole complete painstaking process of selling our home and the great process of buying a home. And whatever we needed, she took care of it without even blinking.. Extremely Professional and knowledgeable Real Estate Agent., you cannot go wrong."

-mrcheek052

Bought and sold a Single Family home in 2023 in Fairfield, CA.

"Bebe did an excellent job of guiding us through selling our home. The process was smooth and we felt confident that everything was getting taken care of. We closed on time and there were no surprises. We highly recommend her."

-Sharon A Gonzalez, Sold a home in 2023.

"Bebe has sold two of our properties. This recent sale was a rental. She was instrumental in coordinating the inspections, repairs and final tenant move out concerns with the property manager. She ensured the smooth flow of disclosure signing, kept us apprised of any issues and changes, and seamlessly worked through the Title Company to drive this sale to close. I would recommend her as a great selling agent."

-Rich Stockand, Sold a home in 2023.

Ready To Get Started?

We see home as more than a house, so we approach real estate as more than a transaction. It’s how we build relationships – by making people feel happy and confident about the biggest investment of their lives. This is more than our profession; it’s our passion because our family never forgets how much home truly means to you and your family. So when you’re ready for your next moment or your next adventure, call Bebe and she will help you get there.

Finding Your Perfect Home in a Fixer Upper

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market or want to stretch your budget further. According to NerdWallet:

“Buying a fixer-upper can provide a path to homeownership for first-time home buyers or a way for repeat buyers to afford a larger home or a better neighborhood. With the relatively low inventory of homes for sale these days, a move-in ready home can be hard to find, especially if you’re on a budget.”

Basically, since the number of homes for sale is still so low, if you’re only willing to tour homes that have all your dream features, you may be cutting down your options too much and making it harder on yourself than necessary. It may be time to cast a wider net.

Sometimes the perfect home is the one you perfect after buying it.

Here’s some information that can help you pinpoint what you truly need so you can be strategic in your home search. First, make a list of all the features you want in a home. From there, work to break those features into categories like this:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle.

- Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of these, it’s a contender.

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner.

Once you’ve sorted your list in a way that works for you, share it with your real estate agent. They’ll help you find homes that deliver on your top needs right now and have the potential to be your dream home with a little bit of sweat equity. Lean on their expertise as you think through what’s possible, what features are easy to change or add, and how to make it happen. According to Progressive:

“Many real estate agents specialize in finding fixer-uppers and have a network of inspectors, contractors, electricians, and the like.”

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment if you ever decide to sell down the line.

Bottom Line

If you haven’t found a home you love that’s in your budget, it may be worth thinking through all your options, including fixer-uppers. Sometimes the perfect home for you is the one you perfect after buying it. To see what’s available in our area, let’s connect.

4401 Avondale Cir

SOLD

→ 4401 Avondale Cir. Fairfield

$1,400,000

| MLS ID: 324004514

Bedrooms: 4 Bathrooms: 3 Square Feet: 3,477 Year Built: 2012 |

Lot Size: 26,589 sq. ft.

Subdivision: Paradise Valley Size: Multi Story Parking: 3 Car Garage HOA: Yes $49/Month |

- Paradise Golf Course

- Views

- Personal Retreat

- Travertine Floors

- Grand Living Room

- Large Granite Island

- Expresso Cabinetry

- Bed & Full Bath Downstairs

- Office Furniture to Convey

- Putting Green

- Pool

- Firepit

With Navigate Real Estate, the process of selling homes and land transcends the conventional approach; it's an artful orchestration of strategy, storytelling, and cutting-edge marketing techniques. Each property is meticulously assessed, and a tailored plan is strategized to ensure maximum exposure and appeal. This approach begins with understanding the unique features and selling points of the home, allowing us to craft a compelling narrative that resonates with potential buyers.

411 Jacquelyn Lane stands as a prime example. Sold by Bebe Sorenson, this meticulously marketed property exemplifies Navigate's dedication to delivering results that exceed expectations.

HOW WE DO IT

- Starts With A Consultation

- 4kHD Video Walkthrough

- Schedule Broker Open

- Create Property Website

- Install For Sale Sign

- Send Through Navigate Network

- Strategically Stage Home

- Drone Airel Photo/Video

- Schedule Open House

- Mass Email Campaign

- Invite Neighbors

- Share Through Social Networks

- Professional Photography

- Professional Written Description

- Create Floor Plans

- Create Brochures

- Advertise your Home

- Folow Up On All Leads

Every Home Has A Story. ..

With our navi in-house marketing agency, we believe each property is different and requires a unique approach to marketing. We will work together and agree upon the best strategy for positioning your home for sale. We approach each real estate transaction differently - working diligently to ensure that each property has its own unique personality and purpose. Our team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

navi

WHO YOU WORK WITH MATTERS

When Bebe Sorenson started her real estate career in 2005 she knew she would enjoy helping others achieve their real estate goals. As time went on she realized that buying or selling real estate is one of the most significant decisions a person will make in a lifetime. Since then it's been her mission to create a smooth efficient experience expertly handled from start to finish.

Bebe prides herself on being attentive to her clients' needs so she can help them make the best choices for their families.

As a forty-five+year resident of Solano County, she has a native's understanding of the area and understands that selling a home is more than putting a sign in the yard. That's why buyers sellers and investors depend on her to guide them and say she is knowledgeable present available and always dedicated to serving their needs.

When not helping her clients Bebe enjoys spending time with her family. She's been happily married for thirty-five+ years and has four children and 9 grandchildren she adores.

+1 707-803-0598 | BebeSorenson@Gmail.com | DRE Lic# 01723224

Raving Fans...

"Could not have done this process.without Ms Bebe Sorensen at our side. She walked My Wife and I slowly and patiently through the whole complete painstaking process of selling our home and the great process of buying a home. And whatever we needed, she took care of it without even blinking.. Extremely Professional and knowledgeable Real Estate Agent., you cannot go wrong."

-mrcheek052

Bought and sold a Single Family home in 2023 in Fairfield, CA.

"Bebe did an excellent job of guiding us through selling our home. The process was smooth and we felt confident that everything was getting taken care of. We closed on time and there were no surprises. We highly recommend her."

-Sharon A Gonzalez, Sold a home in 2023.

"Bebe has sold two of our properties. This recent sale was a rental. She was instrumental in coordinating the inspections, repairs and final tenant move out concerns with the property manager. She ensured the smooth flow of disclosure signing, kept us apprised of any issues and changes, and seamlessly worked through the Title Company to drive this sale to close. I would recommend her as a great selling agent."

-Rich Stockand, Sold a home in 2023.

Ready To Get Started?

We see home as more than a house, so we approach real estate as more than a transaction. It’s how we build relationships – by making people feel happy and confident about the biggest investment of their lives. This is more than our profession; it’s our passion because our family never forgets how much home truly means to you and your family. So when you’re ready for your next moment or your next adventure, call Bebe and she will help you get there.

What To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.

More from the front porch...

4 Tips To Make Your Strongest Offer on a Home

Are you thinking about buying a home soon? If so, you should know today’s market is competitive in many areas because the number of homes for sale is still low – and that’s leading to multiple-offer scenarios. And moving into the peak home buying season this spring, this is only expected to ramp up more. Remember these […]

Read More747 Windham Way

SOLD → 747 Windham Way, Chico $585,000 MLS ID: 223100750 Bedrooms: 4 Bathrooms: 2.5 Square Feet: 2,523 Year Built: 2012 Lot Size: 11,326 sq. ft. Subdivision: Creekside Landing Size: Two Story Parking: Garage (2 Car) HOA: No 🗓️ Schedule Showing 📧 Contact Bebe 📞 707.803.0598 Bed & […]

Read MoreFinding Your Perfect Home in a Fixer Upper

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market […]

Read More4401 Avondale Cir

SOLD → 4401 Avondale Cir. Fairfield $1,400,000 MLS ID: 324004514 Bedrooms: 4 Bathrooms: 3 Square Feet: 3,477 Year Built: 2012 Lot Size: 26,589 sq. ft. Subdivision: Paradise Valley Size: Multi Story Parking: 3 Car Garage HOA: Yes $49/Month 🗓️ Schedule Showing 📧 Contact Us 📞 […]

Read MoreWhat To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An […]

Read MoreThe Truth About Down Payments

The Truth About Down Payments If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case. Unless specified by […]

Read MoreWays Your Home Equity Can Help You Reach Your Goals

If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this: “. . . your home’s equity is the difference between how much your home is worth and how much you […]

Read MoreDown Payment Assistance Programs Can Help Pave the Way to Homeownership

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think: Data from NAR shows the […]

Read MoreWhen You Sell Your House, Where Do You Plan To Go?

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able […]

Read MoreThinking About Using Your 401(k) To Buy a Home?

📈 Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

Read MoreThe Truth About Down Payments

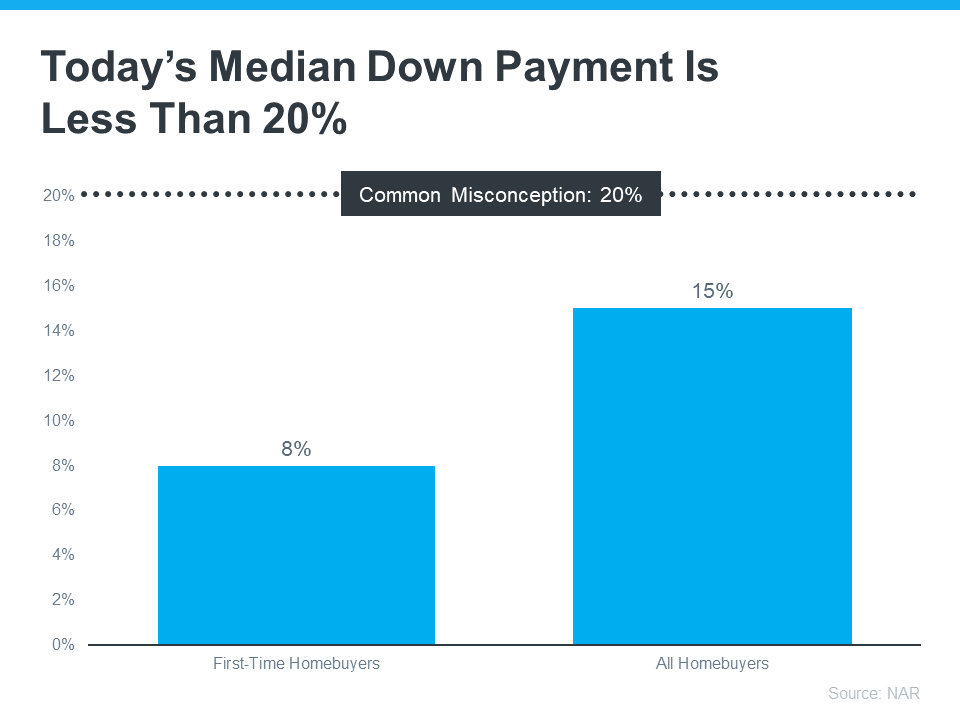

The Truth About Down Payments

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don't always need a 20% down payment to buy a home. If you're looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

More from the front porch...

801 Billhook Dr, Vacaville, CA 95687

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More2395 Front Porch Ln, Rio Vista, CA 94571

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More2913 Willow Ct, Fairfield, CA 94533

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More2156 Holbrook Dr, Concord, CA 94519

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More7 Portola Ct, Santa Rosa, CA 95409

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More136 Southbridge Ln, Fairfield, CA 94534

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More500 Granite Springs Way, American Canyon, CA 94503

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More900 Southampton Rd #110, Benicia, CA 94510

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More3008 Ramsgate Way, Rancho Cordova, CA 95670

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read More4431 Meadow Valley Cir

2 Bedrooms | 1 Baths | 820 sq. ft. →$349,000

Read MoreWays Your Home Equity Can Help You Reach Your Goals

If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

That means your equity grows as you pay down your home loan over time and as home values climb. While it’s true home prices dipped slightly last year, they rebounded and have been climbing in many areas since then. Here’s why that price growth is good news for you.

In the latest Equity Insights Report, Selma Hepp, Chief Economist at CoreLogic, explains:

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year. And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up.”

And that figure is just for the last year. To help you really understand how that number can add up over time, the report also says the average homeowner with a mortgage has more than $300,000 in equity. That much equity can have a big impact.

Here are a few examples of how you can put your home equity to work for you.

1. Buy a Home That Fits Your Needs

If your current space no longer meets your needs, it might be time to think about moving to a bigger home. And if you’ve got too much space, downsizing to a smaller one could be just right. Either way, you can put your equity toward a down payment on something that fits your changing lifestyle.

2. Reinvest in Your Current Home

And, if you’re not ready to move just yet, you can use the equity you have to improve your current home. But it’s important to consider the long-term benefits certain upgrades can bring to your home’s value. A real estate agent is a great resource on which projects to prioritize to get the greatest return on your investment when you sell later on.

3. Pursue Personal Ambitions

Home equity can also serve as a catalyst for realizing your life-long dreams. That could mean investing in a new business venture, retirement, or funding an education. While you shouldn’t use your equity for unnecessary spending, using it responsibly for something meaningful and impactful can really make a difference in your life.

4. Understand Your Options to Avoid Foreclosure

While the number of foreclosure filings remains below the norm, there are still some homeowners who go into foreclosure each year. If you’re in a tough spot financially, having a clear understanding of your options can help. Equity can act as a cushion if you’re not able to make your mortgage payments on time.

Bottom Line

If you want to know how much equity you have in your home, let’s connect. That way you have someone who can do a professional equity assessment report on how much you’ve built up over time. Then let’s talk through how you can use it to help you reach your goals.

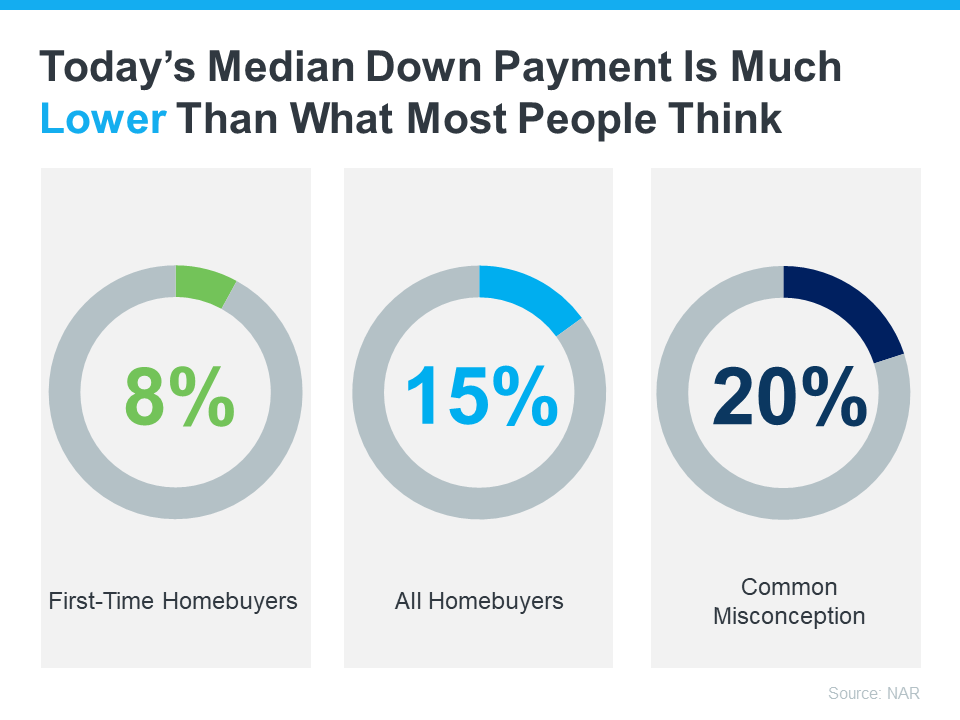

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from NAR shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers at 8%. But just because that’s the median, it doesn’t mean you have to put that much down. Some qualified buyers put down even less.

For example, there are loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. But let’s focus in on another valuable resource that may be able to help with your down payment: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.

And it’s not just first-time homebuyers that are eligible. That means no matter where you are in your homebuying journey, there could be an option available for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

The best place to start as you search for more information is with a trusted real estate professional. They’ll be able to share more information about what may be available, including additional programs for specific professions or communities.

Additional Down Payment Resources That Can Help

Here are a few down payment assistance programs that are helping many of today’s buyers achieve the dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

- Fannie Mae provides down-payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that meet your needs as you explore what’s available.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.

When You Sell Your House, Where Do You Plan To Go?

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able to find a home you want to buy with inventory this low?

One thing that can help you find your next home is exploring all your options, including both homes that have been lived in before as well as newly built ones. Let’s look at the benefits of each one.

The Pros of Newly Built Homes

First, let’s look at the advantages of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

- Create your perfect home. If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

- Cash-in on energy efficiency. When building a home, you can choose energy-efficient options to help lower your utility costs and reduce your carbon footprint.

- Minimize the need for repairs. Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle.

- Have brand new everything. Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

- Explore a wider variety of home styles and floorplans. With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

- Join an established neighborhood. Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

- Enjoy mature trees and landscaping. Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal.

- Appreciate that lived-in charm. The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home.

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. As an article from The Mortgage Reports says:

“When building, you gain more freedom to tailor the design, materials, and features, but it demands more time and involvement. Conversely, buying an established home offers immediate occupancy . . . yet may require compromises. Your choice should align with your budget, timeline, customization preferences, and the local real estate landscape.”

Either way, working with a local real estate agent throughout the process is mission-critical to your success. They’ll help you explore all of your options based on what matters most to you in your next home. Together, you can find the home that’s right for you.

Bottom Line

If you have questions about the options in our area, let’s discuss what’s available and what’s right for you. That way you’ll be ready to make your next move with confidence.

Thinking About Using Your 401(k) To Buy a Home?

📈 Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link